Investing in Land – Splitting Parcels to Make More Profits

In this Initial Installment of Investing in Land we are going to cover why splitting parcels can improve land investment returns, when it is best to split parcels and how to get the process started.

Part I: Why Splitting Parcels Can Improve Returns on Land Investments

Why are parcels priced differently per acre?

Demand: In the world of vacant land, there are many types of buyers and they vary a bit from location to location. But, most locations have dreamers, users and investors. Dreamers buy properties with the intention of using the property to do something years from now and they don’t have a current use for the property (they often purchase smaller parcels). Users have a current need for land. It could be business need like a shooting range (larger parcels) or more acreage for crops/livestock (larger parcels) or it could be a personal need like a place to homestead (parcel size varies), do outdoor recreation (varies) or vacation (small parcels). Investors purchase properties with the intention of renting them or selling them at a higher price (varies).

Each of these groups of land buyers will be focused on different types of land, in different locations and with different acreage amounts. This segmentation often creates price differences based on the type of land, the location of the land and the acreage.

Supply: In some areas vast tracts of land were divided into similar parcel sizes (40 acres or 160 acres) resulting in an oversupply of parcels that size. Additionally, it can be confusing, costly, time consuming and/or difficult to create smaller parcels. As a result few parcels are split into smaller parcels and the oversupply remains for long periods of time. In many of these areas, there are accepted price per acre differences that are larger than the cost of splitting parcels and adding road or easements.

Why can splitting parcels improve returns on land investments?

The per acre price differences between large and small parcels can be dramatic when there are large imbalances between supply and demand. When the ratio of large parcels available to large parcel buyers is greater than the ratio of small parcels to small parcel buyers, smaller parcels will have per acre price premium that should justify the costs of splitting parcels.

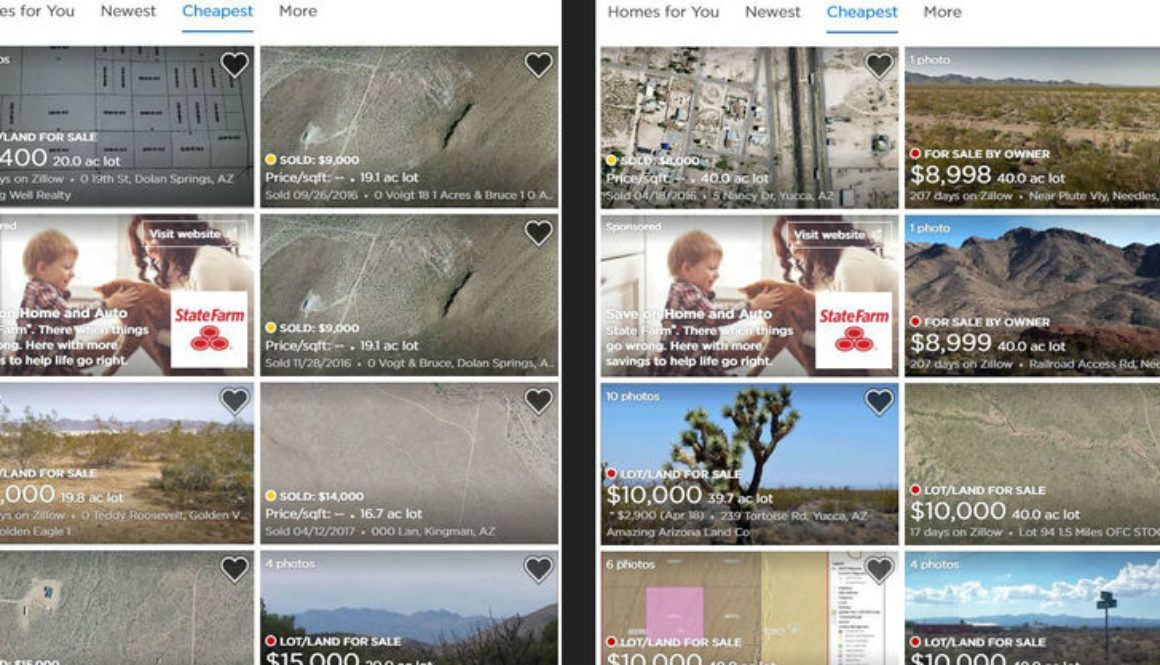

For example, take a look at these screenshots below where 40 acre lots are selling for about the same price as 20 acre lots. If the cost of splitting a parcel was zero, you could effectively get a free 20 acres by purchasing a 40 acre parcel, splitting it and selling half for the same price you purchased the 40 acres for.

Buying land and splitting it

Part II: How to Make Money Splitting Parcels

The first step is to identify an area that will be profitable with this strategy. This entails looking at recent transactions for different parcel sizes. If the smaller parcels are selling at a large premium per acre compared to larger parcels, you are half way to identifying a good location. The second half of this step is to check with the county and ensure that you understand the rules and costs associated with splitting parcels. I have found that surveyors can also be helpful in describing the process and providing information about the cost, difficulty, plausibility and time required to split parcels.

The next step is to check whether you can split the property you are interested in buying. Once you have identified the county you want to pursue this strategy in, locate properties that make good acquisition targets. While going through due diligence on these properties, it is important to check with any property association or HOA rules and any deeded covenants, conditions and restrictions to ensure that you can divide the property as desired.

Finally, after purchasing the property, the process will vary by location. Be sure to submit everything required to the appropriate county offices, property associations, HOAs and any other parties as needed.

If done properly, you can improve your returns by increasing the value of your land investment and its marketability.